Mit Engagement und einem einzigartigen Angebot von Kompetenzen im modernen Fuhrparkmanagement und Leasing kümmern sich unsere Experten um maßgeschneiderte Lösungen für Ihren Fuhrpark.

-

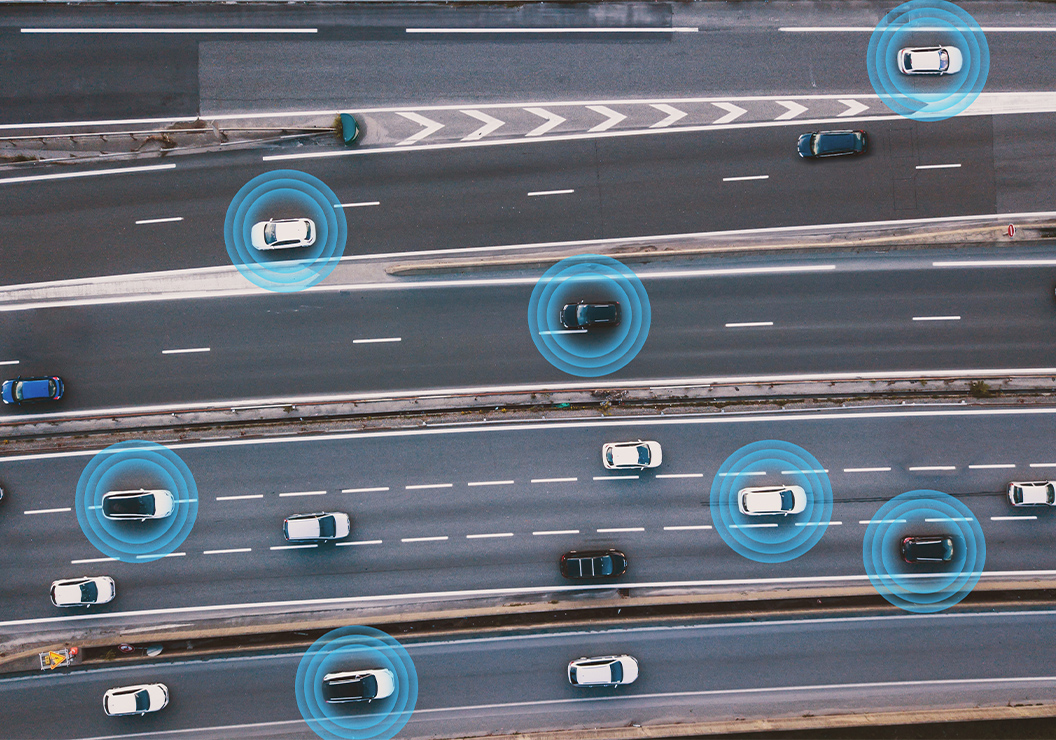

Was wir tunMit unseren integrierten Fuhrparkservices bekommen Sie den ganzen Fuhrparkmanagement- und Leasingmarkt aus einer Hand und können Ihre Flotte kosteneffizient einkaufen, finanzieren, managen und verkaufen. Dabei bezahlen Sie immer nur das, was auch wirklich anfällt.Übersicht

-

RessourcenMit unserem Holman Blog bleiben Sie auf dem Laufenden. Sie finden zudem Pressemitteilungen, Infografiken, Videos und vieles mehr in unserer Bibliothek.Übersicht

-

Über unsAls Holman 1924 gegründet wurde, haben wir etwas Positives in Gang gesetzt. Unser konsequenter Fokus auf den Menschen und unser Engagement für Integrität machen uns zu dem, was wir heute sind.Übersicht

Teil des Teams werdenBei uns dreht sich alles um die besten Lösungen für die Fuhrparks unserer Kunden. Dennoch steht der Mensch hinter dem Telefonhörer, Computer oder Steuer immer an erster Stelle. Werden Sie Teil unseres Teams und steigen Sie ein.Karriere bei Holman

Teil des Teams werdenBei uns dreht sich alles um die besten Lösungen für die Fuhrparks unserer Kunden. Dennoch steht der Mensch hinter dem Telefonhörer, Computer oder Steuer immer an erster Stelle. Werden Sie Teil unseres Teams und steigen Sie ein.Karriere bei Holman